Buying Your First Home

THE ULTIMATE GUIDE FOR HIGH-EARNING 30-SOMETHINGS

Dear Future Homeowner,

First of all — congratulations. Even thinking about buying your first home is a big deal, and it deserves a moment of celebration. It can give you roots, stability, pride of ownership, maybe even a backyard for your pandemic dog.

As you start diving into Zillow porn, let’s have a little heart-to-heart.

Because here’s the truth no one tells you: buying a home is not the guaranteed golden ticket to adulthood that you’ve been sold.

Sure, it can be an amazing lifestyle move. But if you stretch yourself too far by rushing the numbers, chasing trends, or falling for the myth that "buying is always better than renting," you risk locking yourself into years of financial stress you didn’t sign up for.

This guide isn’t here to scare you off. It’s here to help you buy SMARTER.

The four experts you need and what they wish every first-time buyer knew

The reverse timeline to buying a home

How to avoid becoming house poor — even if you’re doing “everything right”

Why buying a home isn’t always smarter than renting.

Here’s what we’ll cover

Let’s get into it,

Priya Malani

Founder and CEO

Stash Wealth

Reverse Timeline

MOVE IN DAY:

WELCOME HOME

Change the locks.

Set up utilities.

Drink champagne and start planning the housewarming.

Review the final numbers (your Closing Disclosure).

Bring a certified check (or wire transfer) for your closing costs.

Get ready to sign your name approximately 173 times.

CLOSING DAY

Make sure agreed-upon repairs are done.

Confirm nothing major changed (like waterdamage, missing appliances, etc.).

Walk through with your broker — this is your last chance to raise issues.

FINAL WALKTHROUGH

Finalize your mortgage paperwork.

Complete the home inspection (and possibly negotiate repairs).

Get homeowner’s insurance lined up.

Your attorney handles title search and review.

CONTRACT TO CLOSE PERIOD

Negotiate final terms: purchase price, contingencies, timing.

Attorney begins contract review.

Complete any additional loan application steps with your lender

OFFER ACCEPTED

Lean heavily on your broker’s advice.

Stay calm — emotional offers lead to overpaying.

Have your pre-approval letter ready to attach.

MAKE AN OFFER

Only tour homes within your realistic

financial plan — not your max pre-approval.

Keep emotions in check: every pretty kitchen isn’t your forever kitchen.

START TOURING HOMES

GET PRE-APPROVED

Before you even set foot in an open house.

Full document review (pay stubs, tax returns, assets).

Know your full "all-in" monthly number — not just the loan amount.

Confirm you’re truly ready — beyond just the down payment.

Ensure buying fits your bigger life goals (not just pressure to "adult").

Plan your cash reserves, emergency fund, and ongoing savings before you buy.

MEET WITH A FINANCIAL ADVISOR

Build your down payment + closing costs + moving expenses + emergency buffer.

The earlier you start, the more flexibility you have when the right home comes along.

BEGIN SAVING EARLY

At Stash Wealth, we help ambitious 30-somethings — people who have the rest of their lives pretty much figured out — finally getting their finances figured out, too.

Our job?

To help you build a smart, sustainable plan that supports your biggest goals — not just your mortgage.

If you’re ready for clear advice, no judgement, and a financial strategy that fits your life (not your parents’), we’re here.

Want to get your financial sh*t together?

First thing’s first

Step 01: Build Out Your Core Team

Buying a home isn’t a solo mission. It’s not just who you have on your team, it’s when you bring them in. Timing matters. These are the people you need in your corner and the order to bring them in:

1. Financial Advisor

Helps you know what you can truly afford before you start browsing.

Make sure you're financially ready to buy without sacrificing the rest of your life. A great financial advisor helps you figure out what you can really afford (not just what a lender says you can afford), protects you from becoming house poor, and ensures your dream home fits into your other dreams.

2. Mortgage Expert

Secures your pre-approval and explains your real buying power.

Once you know what you can truly afford, work with a lending expert to get pre- approved — the right way. They’ll help you explore financing options, understand your monthly costs beyond just the mortgage, and lock in your buying power.

3. Real Estate Broker

Secures your pre-approval and explains your real buying power.

Once you know what you can truly afford, work with a lending expert to get pre- approved — the right way. They’ll help you explore financing options, understand your monthly costs beyond just the mortgage, and lock in your buying power.

Your legal shield for the biggest purchase of your life.

From contract terms to title reports, your attorney is there to protect you from costly mistakes. Buying a co-op or condo? They catch the issues you’d never think to look for. Early involvement is critical—those bylaws and board minutes can hide some expensive surprises. If something looks off, they’ll tell you.

4. Real Estate Attorney

3 Things the Experts Need You to Know

The Financial Adviser

Your primary home isn't an investment you're buying to get a financial return — it's a lifestyle you're buying to live. Thinking of it as an “investment” makes people stretch, overspend, and set expectations that rarely pan out. A financial plan helps you treat homeownership for what it is: one piece of your overall life, not the centerpiece.

1. A Home Is a Life Choice, Not an Investment Strategy

t's easy to think buying a home automatically means you're "winning." But what about the bigger picture? Freedom to travel? Taking a sabbatical? Starting a business? Walking away from a toxic job? Your home shouldn’t be a golden handcuff. A financial advisor helps you understand where a home fits into the life you want.

2. Protect Your Dreams, Not Just Your Square Footage

"You’re still renting?" "Isn’t it time you bought something?" "Interest rates are going up!" (You’ll hear it all.) Here’s the truth: Buying a home should happen on your terms, when your finances - and your goals - are aligned. A financial advisor gives you the clarity (and the language) to shut down the noise and stay focused on what’s right for you.

3. You Don’t Have to Justify Your Timeline to Anyone

Build your home-buying squad

Advisor, lender, broker, attorney—who first, when, and why (for your situation).

The Mortgage Expert

1. Pre-Approval Isn’t Optional — It's Your Golden Ticket

In competitive markets, you can't even submit an offer without a pre-approval letter. Sometimes you can't even tour. A strong pre-approval makes sellers take you seriously. It tells them, "I'm ready, and I’m qualified." Note: A pre-qualification is not the same thing as a pre-approval. You want the real deal; full document review, not just a soft pull.

2. Your “Maximum Approval Amount” Is Not Your Budget

Lenders tell you the most you can borrow — not what you should borrow. Just because you’re approved for $800K doesn’t mean you should spend $800K. Your real budget should leave room for life — travel, fun, emergencies, and future goals.

3. Your Monthly Payment Is More Than Your Mortgage

Beyond principal and interest, you've got Property taxes, Homeowners insurance, Private Mortgage Insurance (PMI) if your down payment is under 20%, HOA fees (if buying a condo/co-op.) Translation: Your "monthly cost" might be 20–30% higher than the mortgage alone. Plan for the full picture, not just the loan payment.

The Real Estate Broker

1. The Listing Price Is Just the Starting Point

The asking price is marketing — not what you’ll pay. Some homes are listed low to spark bidding wars. Others are priced high to "test the market." Your broker helps you read between the lines and figure out what a home is really worth and what it’ll likely go for.

2. You Can (and Should) Negotiate More Than Just Price

Negotiation isn't only about dollars. It's also about closing timeline, repairs or credits after inspection, items to be included (fixtures, appliances, etc.) In a competitive market, terms can matter just as much as price.

3. Your Broker Works for You (Not the Seller)

As a buyer, your agent’s job is to protect your interests — not the seller’s. They’ll help you navigate comps, spot red flags, strategize offers, and avoid emotional decisions that could cost you big. In most cases, the seller pays your broker’s commission, not you.

Let’s make sure you’ve got your financial sh*t together… TOGETHER

A quick Fit-Check maps what you can afford, what to avoid, and how to keep the fun money after closing.

The Real Estate Attorney

1. In Competitive Markets, Involve Your Attorney Early

In places like NYC, you don't wait until closing to bring in your attorney. As soon as you’re preparing an offer, you want your attorney looped in — reviewing terms, prepping for due diligence, and protecting your interests from the start. Especially critical for co-ops and condos, where the fine print can make or break your deal.

2. Contract Terms Matter More Than You Think

It’s not just about price — it’s about contingencies, closing dates, financing clauses, board approvals (for co-ops), and inspection outcomes. Your attorney makes sure what you think you're agreeing to matches what you're actually agreeing to — legally.

3. Red Flags Aren't Always Obvious

Water damage? Special assessments? Building lawsuits? Sketchy bylaws? A good attorney spots issues in the building’s financials, board minutes, and title reports — long before they become your very expensive problem. And if a deal looks shady, they’ll tell you — even if you’re already emotionally attached.

A real-life story from a real-life

Stash Wealth client:

Exactly How to Get Into an 800k Home

”Sophia brought prosciutto-wrapped melon, Olivia brought prosecco, and they’ve been inseparable ever since.”

Sophia is a 35-year-old UX designer at a tech startup. Olivia, 34, is a marketing director at a fast-growing CPG company. They met eight years ago at a rooftop birthday party in Wicker Park—

Meet Sophia & Olivia

It’s not just about price — it’s about contingencies, closing dates, financing clauses, board approvals (for co-ops), and inspection outcomes. Your attorney makes sure what you think you're agreeing to matches what you're actually agreeing to — legally.

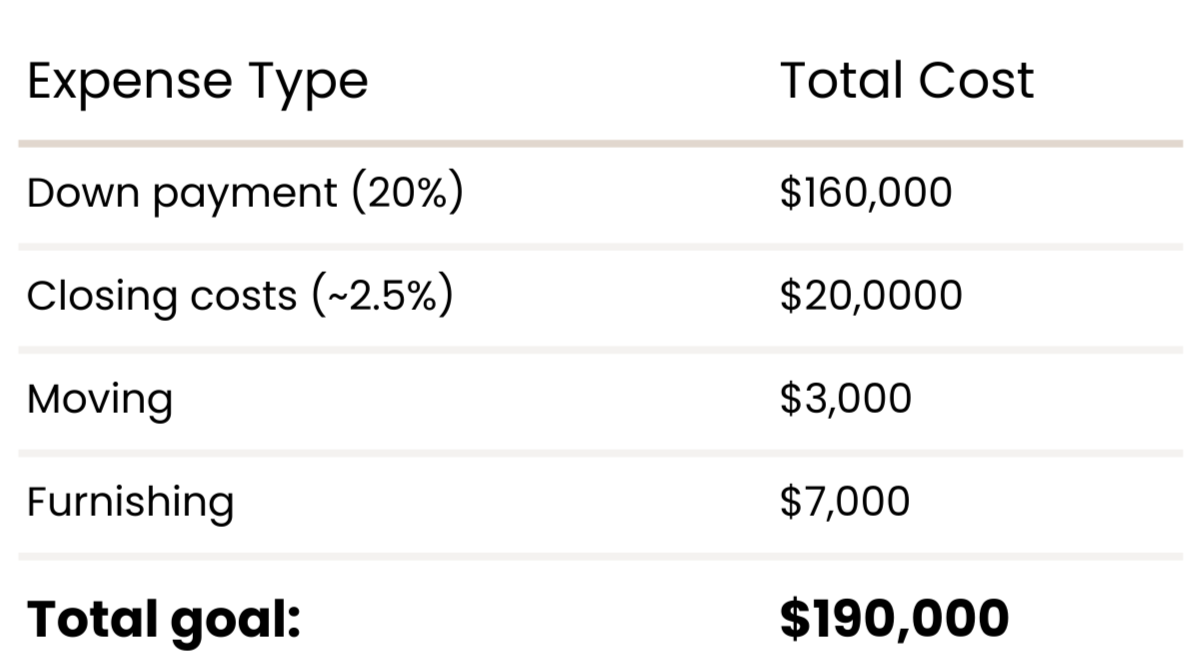

🎯 Target Savings to Purchase

Their Lifestyle Pre-Mortgage

The Monthly Cost of an $800K Home

P.S. Live in a city with co-ops, condos, or quirky closing rules? Your numbers may look different, but the strategy holds: start with your lifestyle, work backward, and don’t let FOMO drive your decisions.

How They Saved

They automated $8,000/month into a high-yield savings account (HYSA) nicknamed “Dream Home.”

*HYSA vs Traditional Bank

Interest earned in HYSA @ 4%: ~$5,700

At a traditional bank @ 0.4%: ~$600

That’s over $5,000 in extra savings earned just by choosing the right account.

The Adjustments They Made

To afford their dream home without sacrificing their lifestyle, they made a few smart trade-offs:

Swapped their annual international trip in exchange for an annual domestic trip

Capped restaurant spending at $500/month

Switched weekend Uber rides for the L

Paused impulsive shopping and added a $300/month shared “splurge” budget

They hit their target in just over 18 months— without relying on saving what’s leftover at the end of the month or disrupting their day-to-day lives.

Stash Wealth Wisdom

Automate to accelerate. They didn’t save faster by trying harder - they saved smarter.

Plan beyond the mortgage. Taxes, maintenance, and insurance are real.

Protect your lifestyle. If your dream home costs you your peace of mind, it’s not the right home.

They’re now living in their dream home.

If you’re buying a home, skip second guessing.

A quick Financial Fit Check replaces late-night Zillow math with clear yes/no numbers, helping you secure your dream home without worrying about the how the hell you’re going to furnish it.

Most first-time buyers start the home search with big dreams and big feelings — but not a lot of real information.

You’re different.

You took the time to understand what buying a home really means — for your lifestyle, your finances, and your future.

Having the right team behind you makes all the difference.

Protecting your lifestyle matters as much as getting the keys.

Your home isn’t an investment strategy.

Now you know:

Wherever you are in your journey — just browsing, getting serious, or about to make an offer — you’re already ahead of 90% of buyers.

For decades, we’ve been told that buying a home is the smartest investment you’ll ever make. Spoiler alert: It’s not. Most people who think their home is making them rich haven’t actually

Homeownerhsip Isn’t the Investment You Think It Is

something to think about…

Here’s what most first-time buyers don’t realize:

🏠 Homes grow in value very slowly, often just a little above inflation.

💵 Hidden costs add up fast: maintenance, repairs, taxes, insurance, upgrades.

🛠 Homes are expensive to sell. Between real estate agent fees, closing costs, and moving expenses, you often need years just to break even.

Bottom line

If you're stretching yourself thin because you believe buying has to be better than renting, you're signing up for financial stress, not “being an adult” with your money. We’re not saying don’t buy a home. We’re saying, don’t expect your home to be your investment strategy. If it appreciates nicely? That’s gravy. Your real wealth-building plan should live elsewhere — like in a 401(k), IRA, brokerage account, or real estate that you don’t live in (i.e. investment property.)

Podcast Episode : Renting is NOT THROWING MONEY AWAY, REALLY

Buy the home, not the headache.

We’ll run your all-in monthly, closing costs, and buffer so you don’t go house-poor.

House Poor

adjective

1. You’re asset-rich, cash-poor, and every month feels like a tightrope walk between your mortgage payment and everything else you want (and need) to do with your life.

🔊 \ haüs pör \

House Prevention Checklist

✅ Read The Ultimate Guide: Buying Your First Home.

⬜ I can comfortably afford the full cost of homeownership.

⬜ I’ll still have 3–6 months of expenses saved after closing.

⬜ I have money set aside to furnish this home.

⬜ I can still invest and enjoy my lifestyle post-move.

⬜ I'm buying based on my goals, not because it feels like the next step.

BONUS

TIP STUFFING: more “ahh, good to knows”

Tip 1 : Where to upgrade your ikea furniture (that’s not facebook marketplace)

Tip 2 : Additional $$ to plan for

Even if you're not buying for a couple of years, setting up an automatic transfer to a high yield savings account nicknamed "Home Fund" now can save you from scrambling for the down payment later.

Closing costs can run 2–5% of the purchase price — on top of your down payment.

Your "monthly cost" might be 20–30% higher than the mortgage alone. Plan for the full picture, not just the loan payment.

Tip 03: Trade contact info

If they’re not a total creep-o, get the contact info of the person you’re buying from (and leave them yours). If there are any mail mishaps or one off questions, which are SUPER common, it’s nice to have a number, just in case.

Champagne Taste, Spritz Budget

Want to talk through your goals with someone who gets you?

Stop wondering if you're doing it right & let's make sure you are.

What are your dream home must haves vs nice to haves? Write it down. To stay on (price) point, get real about your priorities. Or else, you’ll never know what you’ll end up with when the search ends.

Horror Story Time

When Sh*t Literally hit the Fan Basement

You’ve probably heard financial advisors say you need an emergency fund “for when sh*t hits the fan.”

Well... in this case, it didn’t hit the fan. It backed up through the toilet and leaked from the main floor into the basement

Meet Jess and Matt— high earners with two little kids (ages 3 and 5), a nanny, and a brand-new home they moved into just seven weeks ago.

One Tuesday morning, they noticed... a smell.

Turns out, every pipe in the house was backed up. Run the laundry? Sewage out of the toilet. Turn on the faucet? More backup. There was no safe water usage—every drain was connected, and every flush made it worse.

They tried everything: plunging, calling plumbers, hiring cleaners (aka repurposing their nanny),

and evacuating the kids to the wife’s mom’s house—thankfully just two blocks away—because

you can only tell a 5-year-old to “hold it” for so long.

In the end, they spent $500 just managing the initial damage. The real issue? The sewage wasn’t blocked inside the house—it was stuck somewhere between the home and the main line. They had a camera snaked through the pipes, revealing a series of twists and turns that could mean a break underground. Worst case? A $5,000 dig-up-and-replace job.

And of course, this is all happening the week Matt’s parents are flying in from San Diego. To stay. In the basement. For their 5-year-old’s ballet recital.

The best part? During their inspection, the home inspector literally said: “Not only would I move into this house—I’d let my grandkids live here.”

So yeah—if you think saving for your down payment means you’re “ready,” you’re not.

Not yet.

Your emergency fund isn’t just for broken dishwashers. It’s for real-life “oh sh*t”

moments—sometimes involving actual sh*t.

Disclaimer

Every home—and every homeowner—is different. In The Ultimate Guide: Buying Your First Home, we’ve compiled the most helpful insights and strategies we’ve seen resonate with high-earning 30-somethings buying their first place. That said, this guide isn’t exhaustive—we’d need a whole book to cover every scenario, market, and mortgage option out there. Prices shift, preferences vary, and what makes sense for one person may not work for another. Consider this guide your launchpad, not a rulebook: take what fits, tweak what doesn’t, and don’t stress if your path looks a little different. While we’ve highlighted commonly used tools, vendors, and strategies, we don’t receive compensation for these recommendations and can’t take responsibility for any third-party decisions, product issues, or financial outcomes.